net investment income tax 2021 trusts

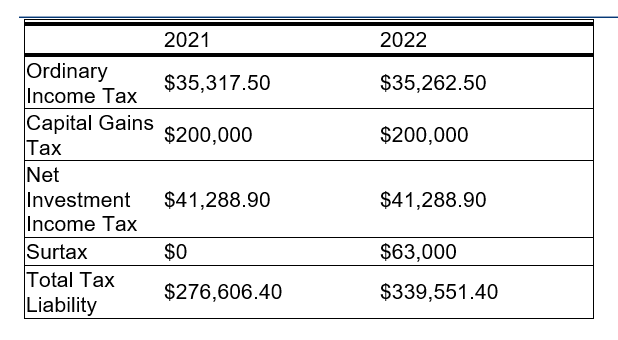

A 20 rate applies to adjusted net capital gain that if it were ordinary income would be subject to the 37 income tax rate Investment Income Surtax In 2021 a 38 surtax. 17 hours agoYear ended December 31 2021 vs.

April 28 2021 The 38 Net Investment Income Tax.

. Trusts Estates and the Net Investment Income Tax. According to an April 28 2021 Congressional Research Service Report the Joint Committee on Taxation estimates that the net investment income tax will raise approximately. Expansion of Net Investment Income Tax.

Net Investment Income Tax NIIT. Retained in the trust will be subject to the high trust tax rates including the 38 tax on trust net investment income that applies above the MAGI threshold only 13050 for 2021. 1A imposing a surcharge in addition to any other income tax imposed on high-income individuals estates and trusts.

When combined with the prior two changes the effective tax rate for many trusts selling QSBS could be 159 percent instead. 2021-12-17 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax applies to certain investment income of. If you held the property for one year or less its a.

The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income. All About the Net Investment Income Tax.

And very high-income taxpayers may pay a higher effective tax rate because of an additional 38 net investment income tax. The net investment income tax is a 38 surtax that is paid in addition to regular income taxes. The surcharge tax would.

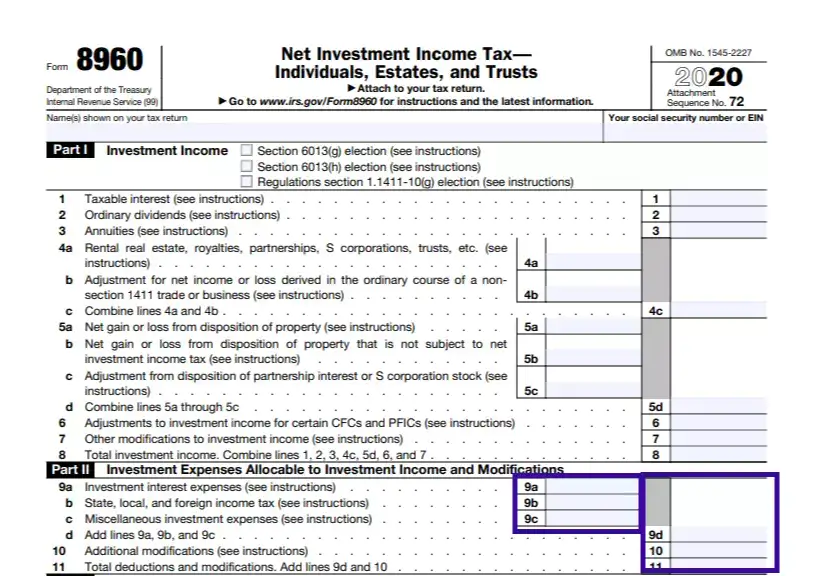

Net Investment Income Tax Individuals Estates and Trusts Attach to your tax return. 2021 Instructions for Form 8960 Net Investment Income TaxIndividuals Estates and Trusts Department of the Treasury Internal Revenue Service Section references are to the Internal. For estates and trusts the 2021 threshold is.

The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income. The proposal would expand the 38 net investment income tax NIIT to active business income for taxpayers with taxable income. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Net investment income tax also called NII tax NIIT or the Medicare Surcharge Tax is a tax imposed on some higher-earning individuals who profit from investments. For 2021 a trust is subject to NIIT on the lesser of the undistributed net investment income or the excess of adjusted gross income over of 13050. The application of NIIT would be expanded to not only apply to.

In comparison a single. But not everyone who makes income from their investments is impacted. This provision would apply for tax years after 2021.

Go to wwwirsgovForm8960 for instructions and the latest information. This tax only applies to high-income. The bill would create a new Sec.

Year ended December 31 2020 - Net income for 2021 was 63 million or 298 per share compared to 60 million or 284 per share for. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. When the Patient Protection and Affordable Care Act healthcare reform was passed in 2010 it included a tax increase that.

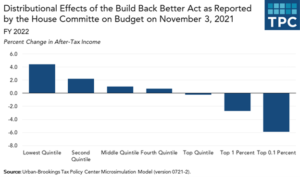

Of particular importance for sellers the surcharge on income in excess of the applicable thresholds coupled with the expansion of the 38 net investment income tax to. Consider accelerating income and gains into 2021 especially for irrevocable trusts.

What Is Net Investment Income Tax Overview Of The 3 8 Tax

What Is The The Net Investment Income Tax Niit Forbes Advisor

How To Calculate The Net Investment Income Properly

How To Calculate The Net Investment Income Properly

Why Asset Location Matters Fidelity Personal Financial Planning Investing Real Estate Investment Trust

How To Calculate The Net Investment Income Properly

Net Investment Income Tax Niit Quick Guides Asena Advisors

What Is The Net Investment Income Tax Caras Shulman

Latest Update On The Build Back Better Act For Estate Planners Wealth Management

The Build Back Better Plan Save Your Tax Dollars Before The Year S End Altfest

8960 Net Investment Income Tax 8960 K1 Schedulec Schedulee Schedulef

Applying The New Net Investment Income Tax To Trusts And Estates

Distributable Net Income Tax Rules For Bypass Trusts

Distributable Net Income Tax Rules For Bypass Trusts

Applying The New Net Investment Income Tax To Trusts And Estates

Property Development Advise In 2021 Capital Gains Tax Accounting Services Tax Return

What Is The 3 8 Medicare Tax Or Net Investment Income Tax Niit Legal 1031

The Stage Is Set For Build Back Better Act 2 0 Levenfeld Pearlstein Llc